Managing payroll is one of the most critical yet time-consuming tasks for small businesses. From calculating employee wages to filing taxes and staying compliant, payroll can become overwhelming—especially without the right software. That’s where QuickBooks for small business with payroll comes in.

Whether you’re a solopreneur using QuickBooks Self-Employed Payroll, or a growing business leveraging Intuit QuickBooks Online Payroll, QuickBooks provides a range of tools to simplify the payroll process while keeping you compliant.

If you need personalized help setting up payroll or managing your QuickBooks system, call 844-753-8012 for expert support.

Why Small Businesses Choose QuickBooks for Payroll

Small businesses need a payroll solution that is:

- Accurate: Automatic calculations for wages, taxes, and deductions.

- Time-saving: Automates recurring payroll tasks.

- Compliant: Handles federal, state, and local tax filings.

- Flexible: Works for contractors, employees, or hybrid models.

- Integrated: Connects seamlessly with QuickBooks accounting and reporting.

Search terms covered:

- QuickBooks for small business payroll

- QuickBooks payroll small business

- Small business payroll QuickBooks

- Intuit payroll for small business

QuickBooks Payroll Options for Small Businesses

1. QuickBooks Self-Employed Payroll

Ideal for freelancers and independent contractors. Features include:

- Simple payroll calculations

- Automatic tax withholdings

- Quarterly tax filing reminders

- Integration with QuickBooks Self-Employed app

Search terms:

- QuickBooks self employed payroll

- Best QuickBooks for small business with payroll

2. Intuit QuickBooks Online Payroll

Designed for small businesses with employees. Features include:

- Automated payroll runs

- Direct deposit to employees

- Tax calculations and filings

- Employee self-service portal

- Integration with QuickBooks Online

Search terms:

- Intuit QuickBooks Online Payroll

- QuickBooks for small business with payroll

- Intuit online payroll QuickBooks

3. SimplyInsured Integration with QuickBooks Payroll

For small businesses looking to manage benefits alongside payroll:

- Health insurance quoting and management

- Integration with QuickBooks for automatic deductions

- Simplified employee onboarding

Search term:

- SimplyInsured Intuit

4. Square Payroll with QuickBooks

Some businesses combine Square Payroll with QuickBooks to:

- Sync payments automatically

- Track contractor payments

- Reconcile payroll in QuickBooks accounting

Search term:

- Square Payroll QuickBooks

Benefits of Using QuickBooks for Payroll

1. Automation Saves Time

QuickBooks can automate:

- Payroll schedules

- Employee payments

- Tax filings

This reduces manual errors and ensures compliance.

2. Seamless Tax Compliance

QuickBooks handles:

- Federal and state tax calculations

- Tax form generation (W-2s, 1099s)

- Direct tax filing with Intuit services

Search terms:

- Intuit online payroll pricing for accountants

- Intuit online payroll to QuickBooks Online Payroll

3. Employee Self-Service

Employees can:

- Access pay stubs online

- View tax documents

- Update personal information

4. Integration with Accounting

All payroll transactions sync automatically with QuickBooks accounting, making reporting and reconciliation easier.

Search terms:

- QuickBooks for small business payroll

- QuickBooks payroll small business

How to Set Up Payroll in QuickBooks

Step 1: Choose Your Payroll Plan

QuickBooks offers multiple plans:

- Self-Employed Payroll (freelancers)

- Core, Premium, or Elite (small business employees)

Step 2: Add Employees or Contractors

- Name, address, and tax info

- Pay rate or salary

Step 3: Connect Bank Account

- For direct deposits

- For payroll tax payments

Step 4: Set Up Pay Schedules

- Weekly, biweekly, or monthly

Step 5: Run Payroll

- QuickBooks calculates paychecks

- Applies deductions

- Generates payroll taxes

QuickBooks Payroll Pricing for Small Businesses

Pricing depends on the plan:

- Self-Employed Payroll: Basic payroll features for freelancers

- Core Plan: Full payroll for small teams

- Premium & Elite Plans: Additional HR support and tax filing

Search terms:

- Intuit online payroll pricing for accountants

- Best QuickBooks for small business with payroll

Tips for Small Businesses Using QuickBooks Payroll

- Keep employee data accurate and up-to-date

- Reconcile payroll with accounting monthly

- Set reminders for tax deadlines

- Utilize employee self-service to reduce administrative work

- Take advantage of benefits integrations like SimplyInsured

Common Payroll Questions for Small Businesses

Q1: Can QuickBooks handle payroll for small business contractors?

Yes, QuickBooks allows you to pay 1099 contractors and report payments.

Q2: Can I use QuickBooks Self-Employed Payroll for employees?

No, Self-Employed Payroll is for freelancers. Use QuickBooks Online Payroll for employees.

Q3: How does Square Payroll integrate with QuickBooks?

Square Payroll syncs employee pay and tax data into QuickBooks automatically.

Q4: Can QuickBooks automatically file payroll taxes?

Yes, with Intuit Online Payroll or QuickBooks Online Payroll plans.

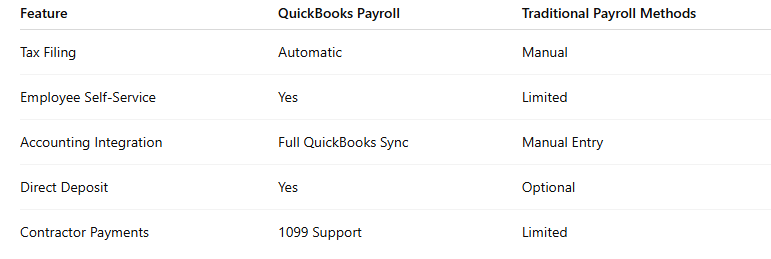

Advantages of Using QuickBooks Payroll Over Competitors

QuickBooks Payroll for Growing Small Businesses

QuickBooks scales with your business:

- Start with Self-Employed Payroll if you have freelancers

- Move to Core or Premium Payroll as you hire employees

- Add HR features with Elite plan for benefits, PTO tracking, and compliance

Search terms:

- Intuit payroll for small business

- QuickBooks for small business with payroll

Conclusion

Managing payroll is no longer a headache for small businesses. With QuickBooks for small business with payroll, you can:

- Automate paychecks

- File taxes on time

- Manage employees and contractors

- Integrate payroll with accounting

Whether you’re a freelancer using QuickBooks Self-Employed Payroll, or a small business scaling with Intuit QuickBooks Online Payroll, QuickBooks provides a reliable, compliant, and time-saving payroll solution.

📞 Call 844-753-8012 today for expert help setting up QuickBooks payroll for your small business.

https://hackmd.io/@upgradequickbookssupport/ByINAFxOblhttps://hackmd.io/@iqbsupport/S1K1p4Vubghttps://hackmd.io/@iqbsupportusa/SJAWkSV_Zlhttps://hackmd.io/@IDbHXj93SHut61h1-ot0Sg/HyZWR8hDWlhttps://hackmd.io/@upgradequickbookssupport/H1H103bPZxhttps://hackmd.io/@iqbsupport/SkOq5rE_Wghttps://qb-subscription-e72a4f.webflow.io/blog/how-to-renew-your-quickbooks-desktop-subscription-complete-step-by-step-guidehttps://qb-subscription-e72a4f.webflow.io/blog/how-to-reactivate-your-quickbooks-payroll-subscriptionhttps://velog.io/@martinsalinasusa/How-to-Purchase-a-QuickBooks-Subscription-for-Your-Business-Complete-2026-Guidehttps://velog.io/@quickbooksform/How-to-Buy-an-Intuit-QuickBooks-Plus-Annual-Subscription-Complete-2026-Guidehttps://velog.io/@qbssupport/Renew-QuickBooks-Subscription-Desktop-Online-Explained-Complete-2026-Guidehttps://hackmd.io/@qberrorsupportexpert/r153TYxu-lhttps://www.eventzilla.net/e/complete-list-of-quickbooks-payroll--us-based-contact-numbers-2138673497?p=0m0ztzcr8thaabgcubqdra569bagz7jfo2avax6uklo85rnlgakk7f0zq30rz62akcviaub6e53gv7bsxy9yx9hjckeh7o5ntny2639070989171876365https://ia902900.us.archive.org/33/items/qbs-helpline-support/Official_Top_list_Of_desktop_list_of_Quickbooks_premier_support.pdfhttps://ia902900.us.archive.org/33/items/qbs-helpline-support/Top_list_Of_QBPS_Payroll_Plus_Official_Support_service_Numbers.pdfhttps://ia902900.us.archive.org/33/items/qbs-helpline-support/Top_list_Of_QBe_Customer_Official_Support_service_Numbers.pdfhttps://ia902900.us.archive.org/33/items/qbs-helpline-support/Top_list_Of_qbd-desktop-support-number-for-reliable-customer-service.pdfhttps://ia902900.us.archive.org/33/items/qbs-helpline-support/Top_list_Of_quickbooks-payroll-support-service-numbers-faqs.pdfhttps://quickbooksrepairpros.com/quickbooks-online-multiple-companie/https://qbonline.help/blog/how-to-view-my-paycheck-in-intuit-workforce-quickbooks-payroll/https://agrodeals.store/quickbooks-data-conversion-services-xero-netsuite-quicken/